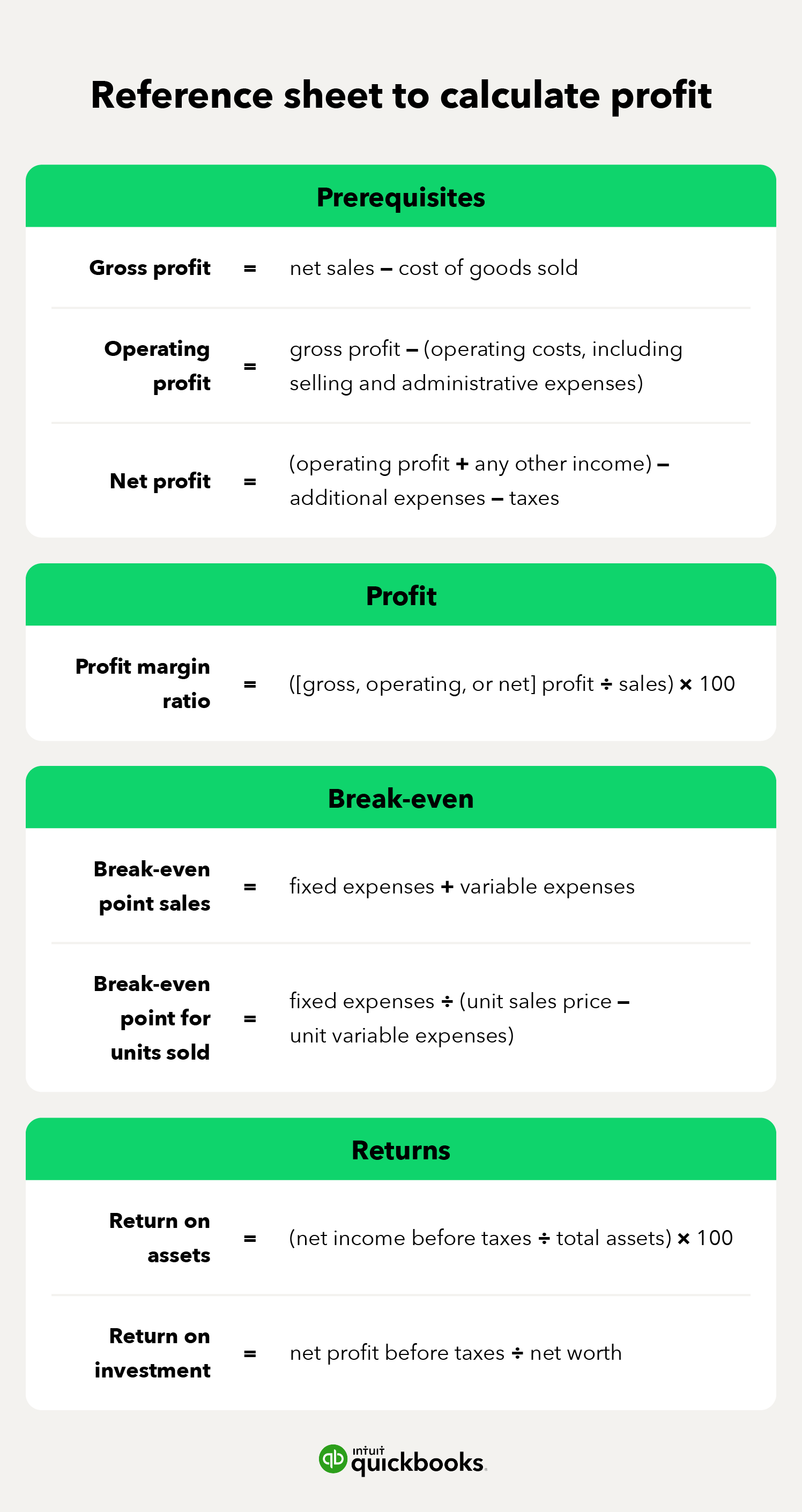

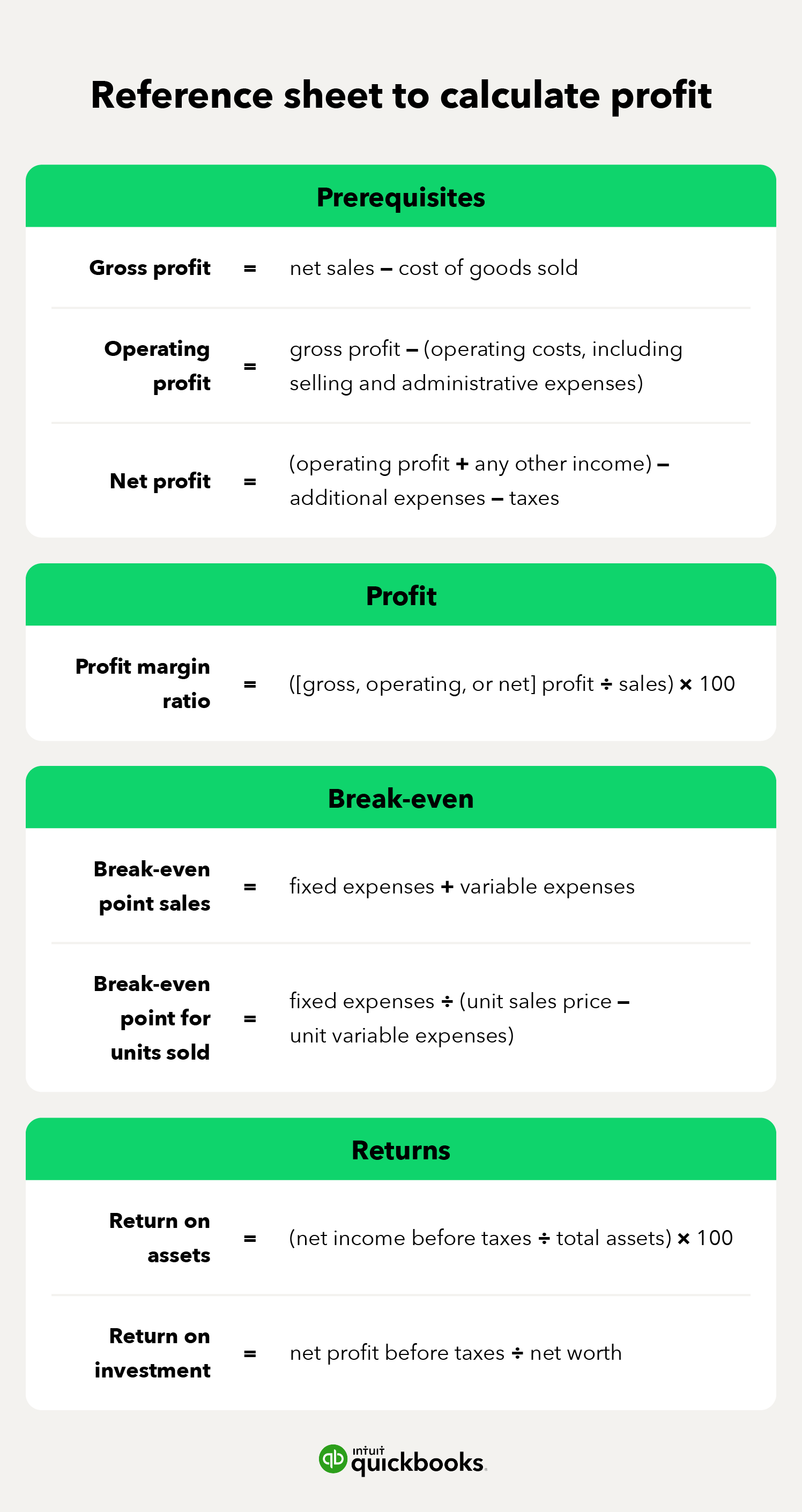

A company's profit margin is calculated by

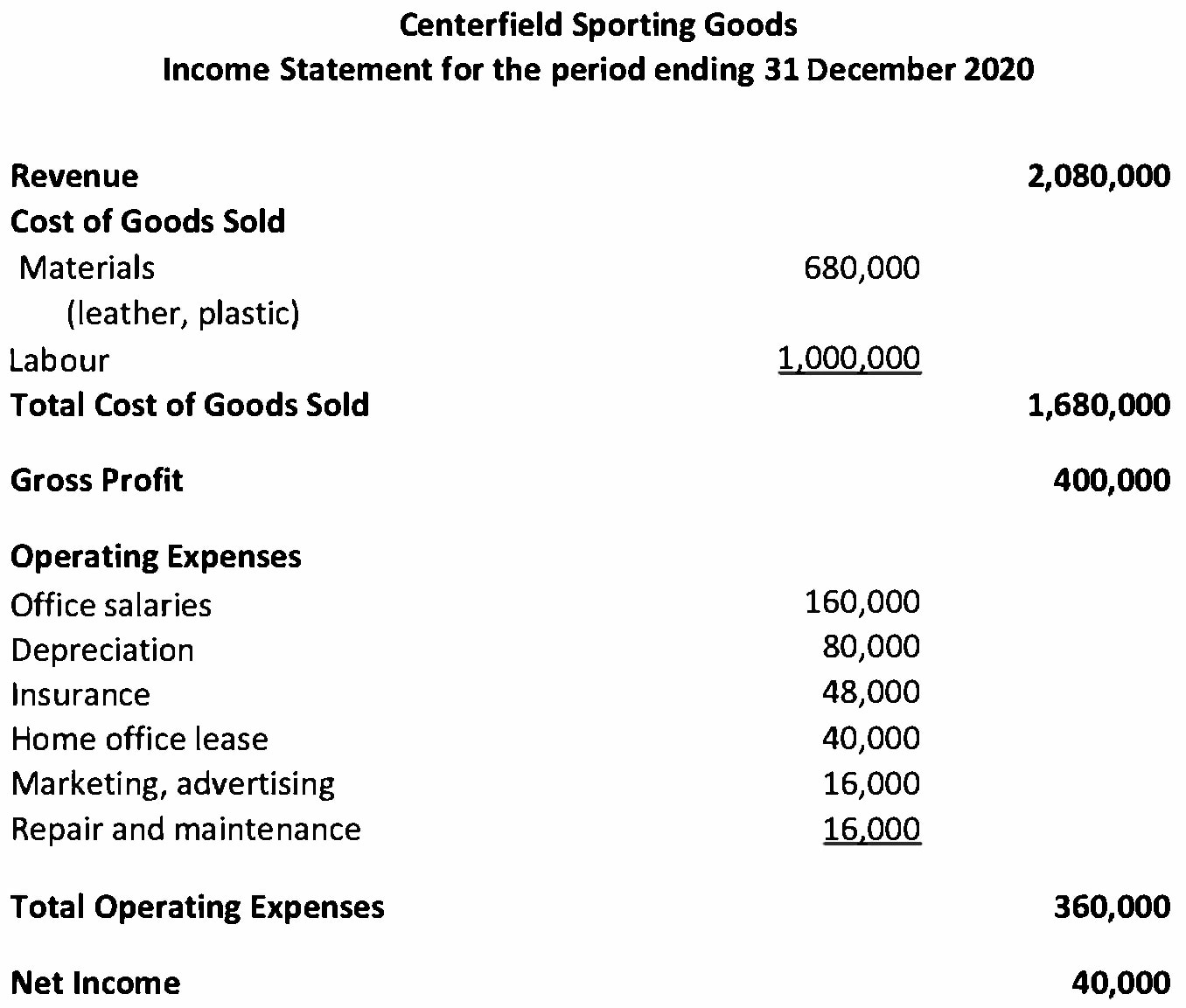

The companys income statement lists both values. The difference between a companys net sales and the cost of goods sold that can be applied to other costs.

How To Calculate Your Profit Margin Learn Accounting Accounting Education Business Analysis

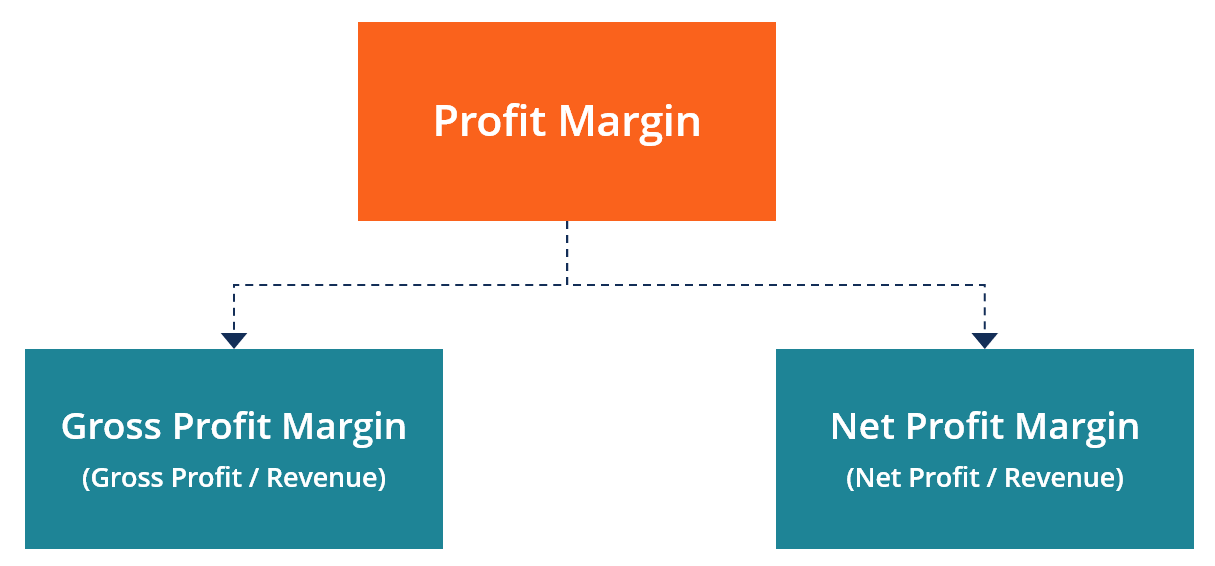

Read more there are two components.

. It is calculated by dividing the operating profit by total revenue and expressing it as a percentage. We note that Net Margin for Colgate has been in the range of 125 15. Differences in competitive strategy and product mix cause the profit margin to vary among different companies.

So now she redoes the calculation as follows. In the example above Tina is wondering if 1875 is adequate. Net margin is calculated for Colgate by dividing Net Profit by Sales.

Total Revenue Cost of Goods SoldTotal Revenue x 100 Gross Profit Margin Or. For example lets say your company generates 200000 in net income and net sales of 600000. The contribution margin represents the amount of income or profit the company made before deducting its fixed costs.

To calculate gross profit margin start by subtracting the cost of goods sold from the net sales. The resulting number indicates a companys profitability but it is generally considered best practice for a company to calculate the operating profit margin too. This is because the operating profit margin allows for more expenses to be included.

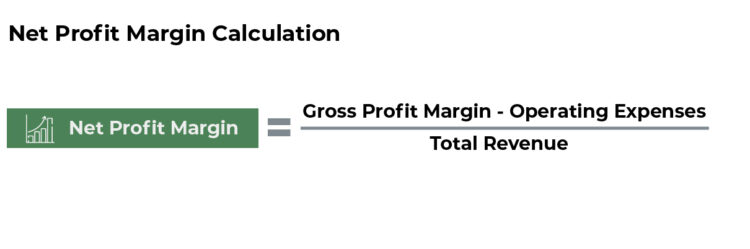

The net profit margin is calculated by deducting from the gross profit operating expenses and any other expenses such as debt. Gross Profit Margin Net Sales - Cost of Goods Sold Net Sales. Simply divide the 50 million gross profit into the sales of 150 million and then multiply that amount by 100.

Said another way it is the amount of sales dollars available to cover or contribute to fixed costs. Key Differences in Gross Profit and Gross Margin. If the proportion of net profit is less than the companys net sales then the investors would inquire why it is so and may find other important details about the company.

Gross Profit Margin Total Revenue Cost of Goods SoldTotal Revenue x 100. Whether you express profit margin as a dollar amount or a percentage its an indicator of the companys financial health. A companys operating profit margin is usually seen as a superior indicator of the strength of a companys management team as compared to gross or net profit margin.

Usually markup is calculated on a per-product basis. Profit margin is the percentage of profit that a company retains. Profit margin formula measures the amount earned earnings by the company with respect to each dollar of the sales generated.

A companys profit is calculated at three levels on its income statement. The gross profit margin is the metric we use to assess a companys financial health by figuring out sales revenue after subtracting the cost of goods sold COGS. Tina may need to know her gross profit margin as a percentage.

A financial metric used to determine how much sales revenue is left after direct cost of production is subtracted. Net profit margin is calculated by taking the companys net income for a given period and dividing by net sales. Subtracting COGS means taking away all the expenses that were incurred during the service rendering.

Profit margin can also be calculated on an after-tax basis but before any debt payments are made. Gross Profit Margin can be calculated by using Gross Profit Margin Formula as follows Gross Profit Margin Formula Net Sales-Cost of Raw Materials Net Sales Gross Profit Margin 100000- 35000 100000 Gross Profit Margin 65. Tinas t-shirt gross profit margin is 1875.

What Is a Good Gross Profit Margin. This is referred. Profit margin is an indicator of a companys pricing strategies and how well it controls costs.

Profit margin is calculated with selling price or revenue taken as base times 100. Revenue COGS Gross Profit. Markup Gross Profit COGS.

So sales profit is calculated as follows. We can use the gross profit of 50 million to determine the companys gross margin. The margin is also known as EBIT Earnings Before Interest and Tax.

This is often the equation used to determine an entire organizations profit margin. When calculated as a ratio it is the percent of sales dollars available to cover fixed costs. ABC is currently achieving a 65 percent gross profit in her furniture business.

These metrics help investors and lenders compare your company to others in the same industry. Net profit margin. Then divide the difference by the net sales to find the gross profit margin.

How to calculate profit margin. Gross profit is the amount remaining after deducting the cost of goods sold COGS or direct costs of earning revenue from revenue. Gross profit margin is a measure of a companys profitability calculated as the gross profit as a percentage of revenue.

If youre not sure what the net sales and.

What Is Gross Margin And How To Calculate It Article

Profit Margin Guide Examples How To Calculate Profit Margins

How Does Gross Margin And Net Margin Differ

What Is Gross Margin Definition Formula And Calculation Ig Uk

/ScreenShot2021-05-28at7.09.49PM-f53a583c48954953a7cd0d23454be040.png)

The Profitability Ratio And Company Evaluation

Gross Profit Margin Formula And Calculator Excel Template

/dotdash_Final_Profit_Margin_Aug_2020-01-853bda68168747d89807dc6ad1053843.jpg)

Profit Margin

![]()

How To Calculate Gross Operating Net Profit Margin

Gross Profit Margin Vs Net Profit Margin Formula

How To Determine Profit Margin For Your Small Business 3 Steps

How To Measure Your Business Profitability Quickbooks Global

Net Profit Margin Calculator Bdc Ca

Net Profit Margin Definition How To Calculate It Tide Business

What Is The Gross Profit Margin Bdc Ca

Net Profit Margin Formula Definition Investinganswers

Profit Margin Formula And Ratio Calculator Excel Template

How To Determine Profit Margin For Your Small Business 3 Steps